Jeevan Anand Plan (Table No 815)

Life Insurance Corporation of India Ltd. Presents,

LIC's New Jeevan Anand Plan is a participating non-linked plan which

offers an attractive combination of protection and savings. This

combination provides financial protection against death throughout the

lifetime of the policyholder with the provision of payment of lumpsum at

the end of the selected policy term in case of his/her survival. This

plan also takes care of liquidity needs through its loan facility.

Benefits:-

(1) Death benefit :

Provided all due premiums have been paid, the following death benefit shall be paid:

• On Death during the policy term: Death benefit, defined as sum of “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable. Where, “Sum Assured on Death” is defined as higher of 125% of Basic Sum Assured or 10 times of annualized premium. This death benefit shall not be less than 105% of all the premiums paid as on date of death.

The premiums mentioned above exclude service tax, extra premium and rider premiums, if any.

• On death of policyholder at any time after policy term: Basic Sum Assured

Benefits payable at the end of Policy Term: Basic Sum Assured, along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable in lump sum on survival to the end of the policy term provided all due premiums have been paid.

• On Death during the policy term: Death benefit, defined as sum of “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable. Where, “Sum Assured on Death” is defined as higher of 125% of Basic Sum Assured or 10 times of annualized premium. This death benefit shall not be less than 105% of all the premiums paid as on date of death.

The premiums mentioned above exclude service tax, extra premium and rider premiums, if any.

• On death of policyholder at any time after policy term: Basic Sum Assured

Benefits payable at the end of Policy Term: Basic Sum Assured, along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable in lump sum on survival to the end of the policy term provided all due premiums have been paid.

Participation in Profits : The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation during policy term provided the policy is in full force.

Final (Additional) Bonus may also be declared under the plan in the year when the policy results into death claim during the policy term or due for the survival benefit payment provided the policy is in full force and has run for certain minimum term.

Final (Additional) Bonus may also be declared under the plan in the year when the policy results into death claim during the policy term or due for the survival benefit payment provided the policy is in full force and has run for certain minimum term.

(2) Optional Benefit:

LIC’s Accidental Death and Disability Benefit Rider: LIC’s Accidental Death and Disability Benefit Rider is available as an optional rider by payment of additional premium during the policy term. In case of accidental death during the policy term, Accident Benefit Sum Assured will be payable as lumpsum along with the death benefit under the basic plan. In case of accidental permanent disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly installments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured which is equal to Accident Benefit Sum Assured under the policy, shall be waived.

LIC’s Accidental Death and Disability Benefit Rider: LIC’s Accidental Death and Disability Benefit Rider is available as an optional rider by payment of additional premium during the policy term. In case of accidental death during the policy term, Accident Benefit Sum Assured will be payable as lumpsum along with the death benefit under the basic plan. In case of accidental permanent disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly installments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured which is equal to Accident Benefit Sum Assured under the policy, shall be waived.

Statutory warning:

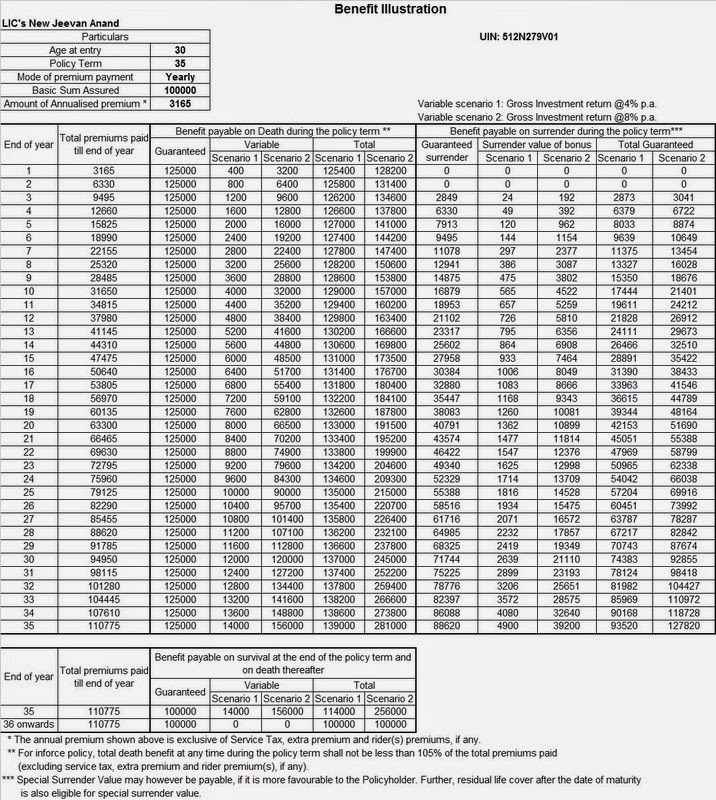

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

1. Eligibility Conditions and Other Restriction :

For Basic plan

a) Minimum Basic Sum Assured : Rs. 100,000

b) Maximum Basic Sum Assured : No Limit

(The Basic Sum Assured shall be in multiples of Rs. 5000/-)

c) Minimum Age at entry : 18 years (completed)

d) Maximum Age at entry : 50 years (nearest birthday)

e) Maximum Maturity Age : 75 years (nearest birthday)

f) Minimum Policy Term : 15 years

g) Maximum Policy Term : 35 years

For LIC’s Accidental Death and Disability Benefit Rider

a) Minimum Accident Benefit Sum Assured : Rs. 100,000

b) Maximum Accident Benefit Sum Assured :

An amount equal to the Basic Sum assured under the Basic Plan subject to the maximum of Rs.50 lakh overall limit taking all existing policies of the Life Assured under individual as well as group schemes including policies with inbuilt accident benefit taken with Life Insurance Corporation of India and the Accident Benefit Sum Assured under the new proposal into consideration.

(The Accident Benefit Sum Assured shall be in multiples of Rs. 5000/-)

c) Minimum Age at entry : 18 years (completed)

d) Maximum Age at entry : The cover can be opted for at any policy anniversary during the policy term but before the policy anniversary on which the age nearer birthday of the Life Assured is 70 years.

e) Maximum cover ceasing age : 70 years (nearest birthday) or till the end of the Policy

Term, whichever is earlier.

2. Payment of Premiums:

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (through ECS only or through salary deductions) over the Policy Term.

However, a grace period of one calendar month but not less than 30 days will be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums.

a) Minimum Accident Benefit Sum Assured : Rs. 100,000

b) Maximum Accident Benefit Sum Assured :

An amount equal to the Basic Sum assured under the Basic Plan subject to the maximum of Rs.50 lakh overall limit taking all existing policies of the Life Assured under individual as well as group schemes including policies with inbuilt accident benefit taken with Life Insurance Corporation of India and the Accident Benefit Sum Assured under the new proposal into consideration.

(The Accident Benefit Sum Assured shall be in multiples of Rs. 5000/-)

c) Minimum Age at entry : 18 years (completed)

d) Maximum Age at entry : The cover can be opted for at any policy anniversary during the policy term but before the policy anniversary on which the age nearer birthday of the Life Assured is 70 years.

e) Maximum cover ceasing age : 70 years (nearest birthday) or till the end of the Policy

Term, whichever is earlier.

2. Payment of Premiums:

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (through ECS only or through salary deductions) over the Policy Term.

However, a grace period of one calendar month but not less than 30 days will be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums.

3. Sample Premium Rates:

Following are some of the sample tabular premium rates (exclusive of service tax) per Rs. 1000/- Basic Sum Assured:

4. Mode and High S.A. Rebates:Mode Rebate:

Yearly mode - 2% of Tabular Premium

Half-yearly mode - 1% of Tabular premium

Quarterly & Monthly mode - NIL

High Sum Assured Rebate:

Basic Sum Assured (B.S.A) Rebate (Rs.)

1, 00,000 to 1, 95,000 - Nil

2, 00,000 to 4, 95,000 - 1.50%o B.S.A.

5, 00,000 and 9, 95,000 - 2.50%o B.S.A.

10, 00,000 and above - 3.00%o B.S.A.

Yearly mode - 2% of Tabular Premium

Half-yearly mode - 1% of Tabular premium

Quarterly & Monthly mode - NIL

High Sum Assured Rebate:

Basic Sum Assured (B.S.A) Rebate (Rs.)

1, 00,000 to 1, 95,000 - Nil

2, 00,000 to 4, 95,000 - 1.50%o B.S.A.

5, 00,000 and 9, 95,000 - 2.50%o B.S.A.

10, 00,000 and above - 3.00%o B.S.A.